Time charter rates

The Container market has seen an unprecedented increase in rates since the end of 2020. Container 1 year TC rates have surged to extraordinarily new highs with 8,500 TEU values rising to a record 54,000 USD/day for April. This is an increase of 350% since June 2020.

Throughout 2020 the market fell significantly from impacts due to the Covid-19 pandemic. There was a significant decrease in demand as the uncertain circumstances surrounding the beginning of a global pandemic hit the consumer market hard.

Towards the end of 2020 trade started to rebound and since the beginning of 2021 a firm recovery has taken place. A combination of widespread logistical disruption amplified the positive impacts on the markets. A shortage of box availability in Asia had a particularly strong effect and an increase in port congestion has all led to a significant firming in rates.

Speeds

Alongside the increasing rates in the Container sector, we have seen a significant increase in average laden speeds travelled. In this current situation with rapidly increasing rates, vessels are moving faster.

Container speeds hit a five-year low in May 2020 as a result of reduced demand due to Covid, blank sailings and port delays.

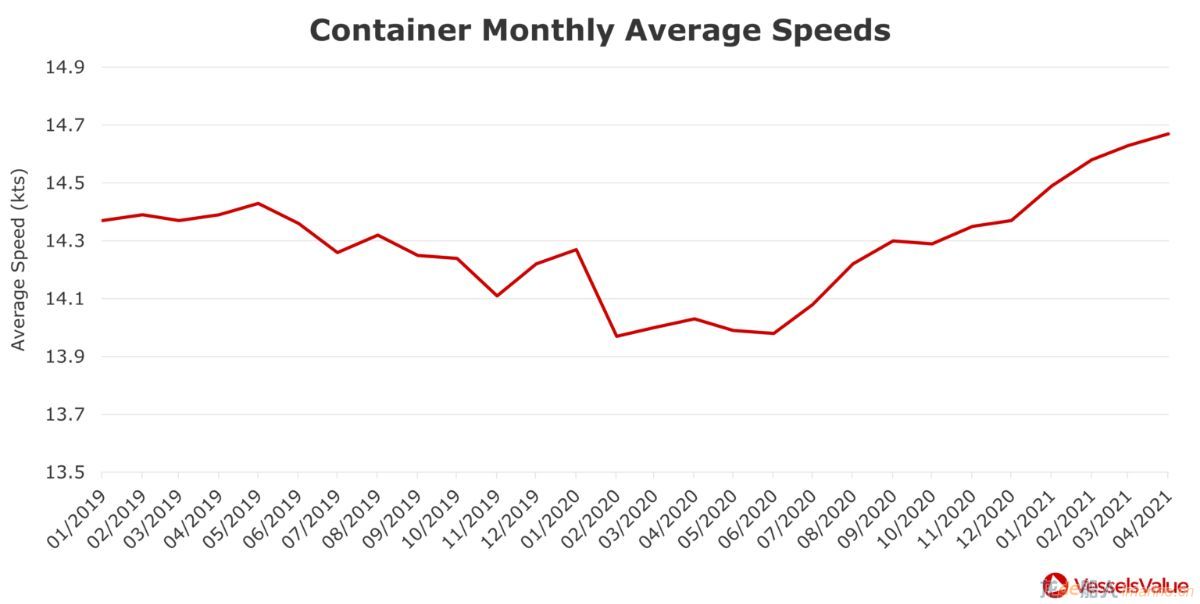

Figure 1 shows monthly average speeds since the start of 2019 for all Container vessels. Container speeds and container rates have both been following the same upward trajectory since mid-2020. Container speeds across all types have jumped 5.5% since June 2020, from 13.99 knots to 14.76 knots, with some of the larger types increasing by more.

-->

-->

Figure 1 – Container Monthly Average Speeds

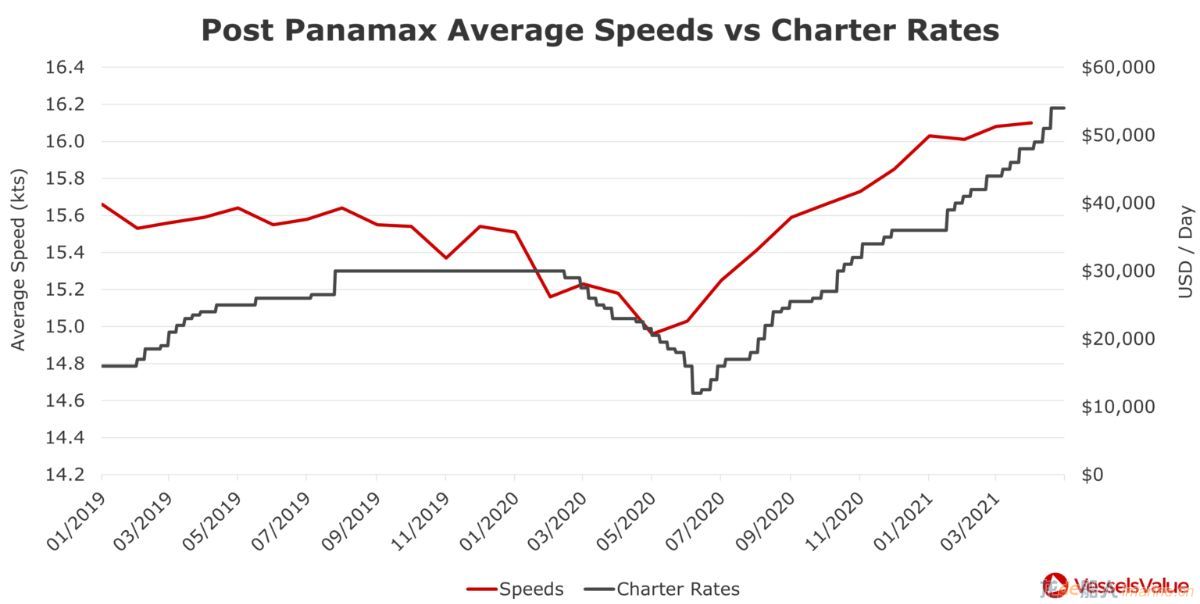

Speeds travelled by Containerships are directly correlated to charter rates as seen in figure 2.

Post Panamax average speeds between June 2020 and April 2021 have increased significantly by 8.5%. Across the same time period, Post Panamax rates have risen by 350%, from $12,000 per day in June 2020, to now currently reaching $54,000 per day in April 2021.

-->

-->

Figure 2 – Post Panamax Container Monthly Average Speeds vs Charter Rates

Container Cargo Miles

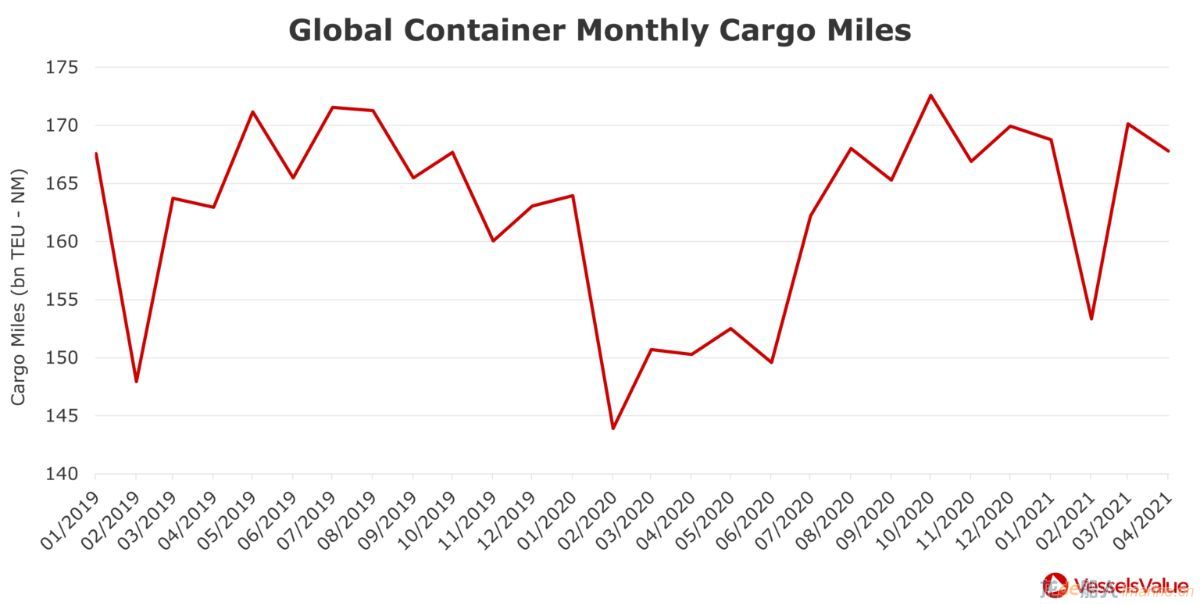

VesselsValue Trade data allows us to track cargo miles over time for any sector. Cargo miles combine actual distances sailed by each vessel and estimates of cargo volumes to indicate the true demand for vessels. Figure 3 shows global Container monthly estimated cargo miles back to January 2020.

-->

-->

Figure 3 – Global Container Monthly Estimated Cargo Miles (bn TEU-NM)

Cargo miles in 2020 declined overall between February and June. A drop at the start of the year is normal due to the Chinese New Year period, however, the decline was prolonged in 2020 due to the onset of Covid-19, disrupting exports from Asia into June. Between June and July 2020, monthly cargo miles increased by 8% from 150 bn TEU-NM to just over 160 bn TEU-NM, suggesting a rapid recovery in demand. This was helped by Western countries also easing lockdowns.

Since then, cargo miles in the last few months of 2020 stayed consistently high, with October 2020 cargo miles exceeding October 2019 cargo miles by 3%. This February’s cargo miles were also 6% up on last February and 4% up on February 2019 (pre-Covid), suggesting continued strong demand in the Container market. More recently, in March 2021, cargo miles continued to grow with rates, surpassing peak levels seen in 2019.

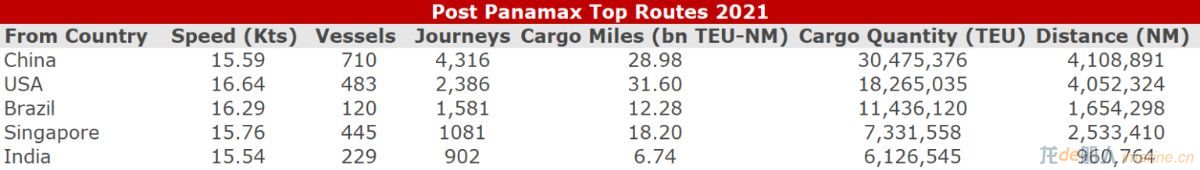

This growth is primarily driven by exports from China. Figure 4 shows some of the top routes for Post Panamax containers so far this year. China ranks highest, with almost three times the number of journeys leaving the country compared to the USA. The success of vaccine programmes is another good sign for the Container market, as we expect the demand for goods and cargo miles to continue rising, along with rates.

-->

-->

Figure 4 – Post Panamax Top Routes 2021. Vessels leaving countries sorted by highest Journey count

Forecasting

-->

-->

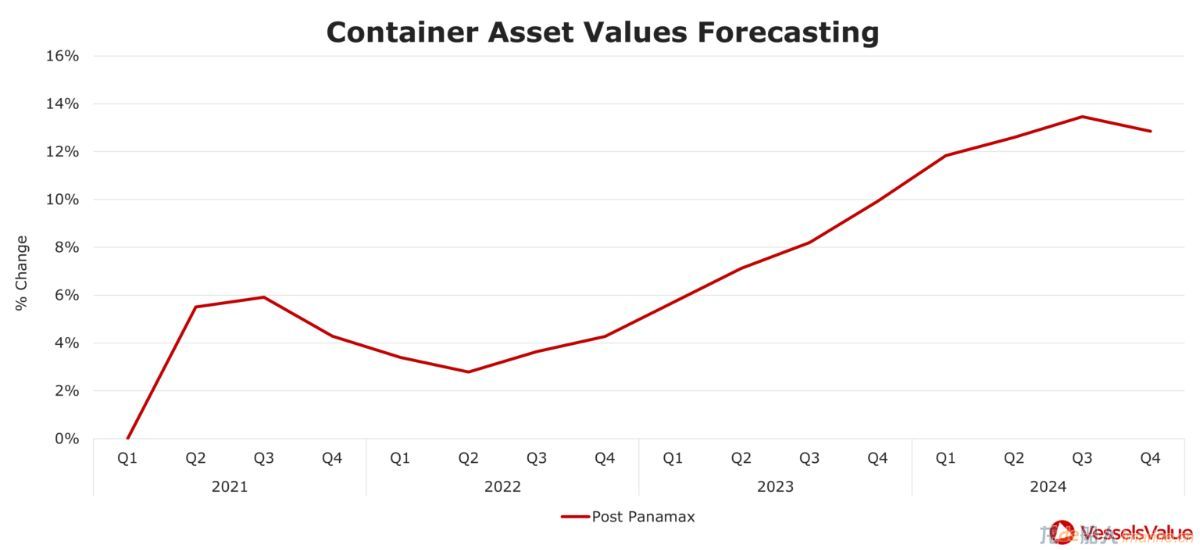

Figure 5 – percentage change of the forecasted value for Post Panamax Containers from Q1 2021 through to Q4 2024

Demand growth in 2021 is expected to improve 5.3% from 2019 pre-Covid levels, with 2020 having declined 0.7%. The demand increase is supported by continued online purchasing but is expected to ease up as the vaccination programmes take hold and mobility starts to normalise. Rebounding manufacturing levels in the Western economies could support demand levels throughout the second half of the year and into 2022.

The large relief packages in the US are also likely to support Eastbound Transatlantic shipments and paired with a likely weakening and more competitive US dollar, the export market could strengthen overall backhauls for the main lanes. As we argue that both consumer and business confidence are likely to strengthen throughout the year, 2022 is estimated to maintain a healthy demand growth of around 4%.

Scrapping has naturally slowed down significantly from Q3 2020 with rising earnings, and we expect continued muted levels through 2021. New orders have picked up to 1.1 mil TEU since Q3 2020 or 4.6% of the fleet, and this month alone there have been 50 new orders for Containerships, however all for sizes >10,000 TEU. Containerships supply is set to increase over the next two years, but with lower fleet growth than in 2020. After a significant increase in freight rates during this prolonged peak period, earnings are expected to soften slightly from current levels during 2022, but remain steady into 2023-24, setting the stage for a multi-year peak market.

|